Neural Networks in R (Part 3 of 4) - Neural Networks on Price Changes in Financial Data

This post is a demonstration using the caret and nnet packages on aggregate Big Five traits per state and political leanings, and a continuation of a series:

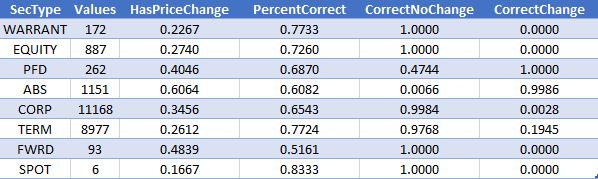

Initially, the results seemed promising, with a prediction accuracy of ~.85, further analysis revealed that the bulk of accurate predictions were those that had no price change, and that price change classes were often inaccurate. I excluded security types without price change, and the average dropped even further. I then created a loop that calculated test and training data by security type, and those result indicated that the neural net very right and very wrong, for price change state. Only one security seemed remotely predicted, that of PFD.

The code is below, as are some related graphs. Source data cannot be provided.

- Neural Networks (Part 1 of 4) - Logistic Regression and neuralnet on State 'Personality' and Political Outcomes

- Neural Networks (Part 2 of 4) - caret and nnet on State 'Personality' and Political Outcomes

Initially, the results seemed promising, with a prediction accuracy of ~.85, further analysis revealed that the bulk of accurate predictions were those that had no price change, and that price change classes were often inaccurate. I excluded security types without price change, and the average dropped even further. I then created a loop that calculated test and training data by security type, and those result indicated that the neural net very right and very wrong, for price change state. Only one security seemed remotely predicted, that of PFD.

The code is below, as are some related graphs. Source data cannot be provided.

################################################

# create formula used for all samples

################################################

#names(Portfolio.df)

equation <- as.formula("PriceChange ~ Coupon + Duration + Convexity")

################################################3

# Neural Net with nnet and caret

# Filtering comparisons

################################################3

# load packages

library(nnet)

library(caret)

# set parameters for loop

secTypes <- unique(Portfolio.df$Sec_Type)

numRows <- length(secTypes)

# create empty data frame, for best performance

Filtered.Predictions <- data.frame(SecType = character(numRows), Values = numeric(numRows), HasPriceChange = numeric(numRows), PercentCorrect = numeric(numRows), PercentCorrectNoChange = numeric(numRows), PercentCorrectChange = numeric(numRows), stringsAsFactors = FALSE)

# loop through parameters and neural net to buil;d results

currentRow = 0

for (secType in secTypes) {

currentRow <- currentRow + 1

# filter data set

Portfolio.filtered <- Portfolio.df.preclean[Portfolio.df.preclean$Sec_Type == secType,]

#View(Portfolio.df.preclean)

# only work on assets with price changes

if ((sum(ifelse(Portfolio.filtered$PriceChange == 1, 1, 0)) / nrow(Portfolio.filtered)) >= 0.0) {

# add sec type to result data frame

Filtered.Predictions$SecType[currentRow] <- secType

# add number of values to result data frame

Filtered.Predictions$Values[currentRow] <- nrow(Portfolio.filtered)

Filtered.Predictions$HasPriceChange[currentRow] <- (sum(ifelse(Portfolio.filtered$PriceChange == 1, 1, 0)) / nrow(Portfolio.filtered))

# train

Portfolio.filtered.train <- train(equation, Portfolio.filtered, method = 'nnet', linout = TRUE, trace = FALSE)

# predict

Portfolio.filtered.predicted <- predict(Portfolio.filtered.train, Portfolio.filtered)

# combine

Portfolio.filtered.combined <- cbind(Portfolio.filtered.predicted, Portfolio.filtered)

# calculate correct

Portfolio.filtered.combined$predictionBinary <- ifelse(Portfolio.filtered.combined$Portfolio.filtered.predicted >= .5, 1, 0)

Portfolio.filtered.combined$Correct <- ifelse(Portfolio.filtered.combined$predictionBinary == Portfolio.filtered.combined$PriceChange, 1, 0)

correct <- (sum(Portfolio.filtered.combined$Correct) / length(Portfolio.filtered.combined$Correct))

# calculate correct, no change

Portfolio.filtered.combined.NoChange <- Portfolio.filtered.combined[Portfolio.filtered.combined$PriceChange == 0,]

correctNoChange <- (sum(Portfolio.filtered.combined.NoChange$Correct) / length(Portfolio.filtered.combined.NoChange$Correct))

# calculate correct, change

Portfolio.filtered.combined.Change <- Portfolio.filtered.combined[Portfolio.filtered.combined$PriceChange == 1,]

correctChange <- (sum(Portfolio.filtered.combined.Change$Correct) / length(Portfolio.filtered.combined.Change$Correct))

# add percent correct to result

Filtered.Predictions$PercentCorrect[currentRow] <- correct

Filtered.Predictions$PercentCorrectNoChange[currentRow] <- correctNoChange

Filtered.Predictions$PercentCorrectChange[currentRow] <- correctChange

}

}

# display results

Filtered.Predictions <- Filtered.Predictions[Filtered.Predictions$HasPriceChange > 0,]

# plots percent correct for change versus percent correct for no change

library(ggplot2)

plotPart1 <- ggplot(data = Filtered.Predictions, aes(x = HasPriceChange, y = PercentCorrect))

plotpart2 <- plotPart1 + geom_point() + stat_smooth(method = "lm", formula = y ~ x, size = 1)

plotpart2 + geom_text(aes(label = SecType), hjust = 0, vjust = 0, nudge_x = -.00, nudge_y = .005, angle=0, size=3)

Comments

Post a Comment